Smart, funny, fast-paced, full of heart, The Big Short offers a social consciousness rarely found in Hollywood films. It also does the nearly impossible by making the intricacies of the 2008 financial crisis understandable for non-economists.

We see the human face of the mortgage meltdown, from distressed homeowners to a cohort of non-sophisticated oddball/outsiders who saw the crisis coming before it erupted. Christian Bale plays Dr. Michael Burry, a brilliant fund manager with Asperger syndrome who takes refuge in his heavy metal drum kit. Ryan Gosling portrays a slick Wall Street insider who turns to the camera and offers shocking truths in a casual voice. Brad Pitt is the older, jaded Wall Street player who’s left the game, yet helps two dorky twenty-something investors who are prescient about the crisis. The heart of the film is Steve Carell as a Wall Street insider who mourns when his bet finally pays off.

The film points out the corruption of the big banks, how their greed and stupidity drove them off the cliff, creating horrible consequences for millions of people in the process. Savings, careers, hopes, families and lives were destroyed by the collapse. Yet as the movie shows, no one was held accountable, and nothing has fundamentally changed. Sure, there was financial legislation in response, but – in the film’s opinion – it is hardly true oversight of mega-powerful financial institutions.

I want to believe that, with time, there will be demand for better, more consumer-centric regulation. That’s idealistic, probably, though as this Atlantic article argues, America is shifting leftward politically (however, the New Republic argues the opposite). Any candidate who advocates for a fairer financial system would certainly get voter interest. The excitement about Elizabeth Warren and Bernie Sanders is clearly fueled by this sentiment. Sanders has pulled Hillary Clinton leftward. We’ll see – certainly reform is needed for our long term health as a nation.

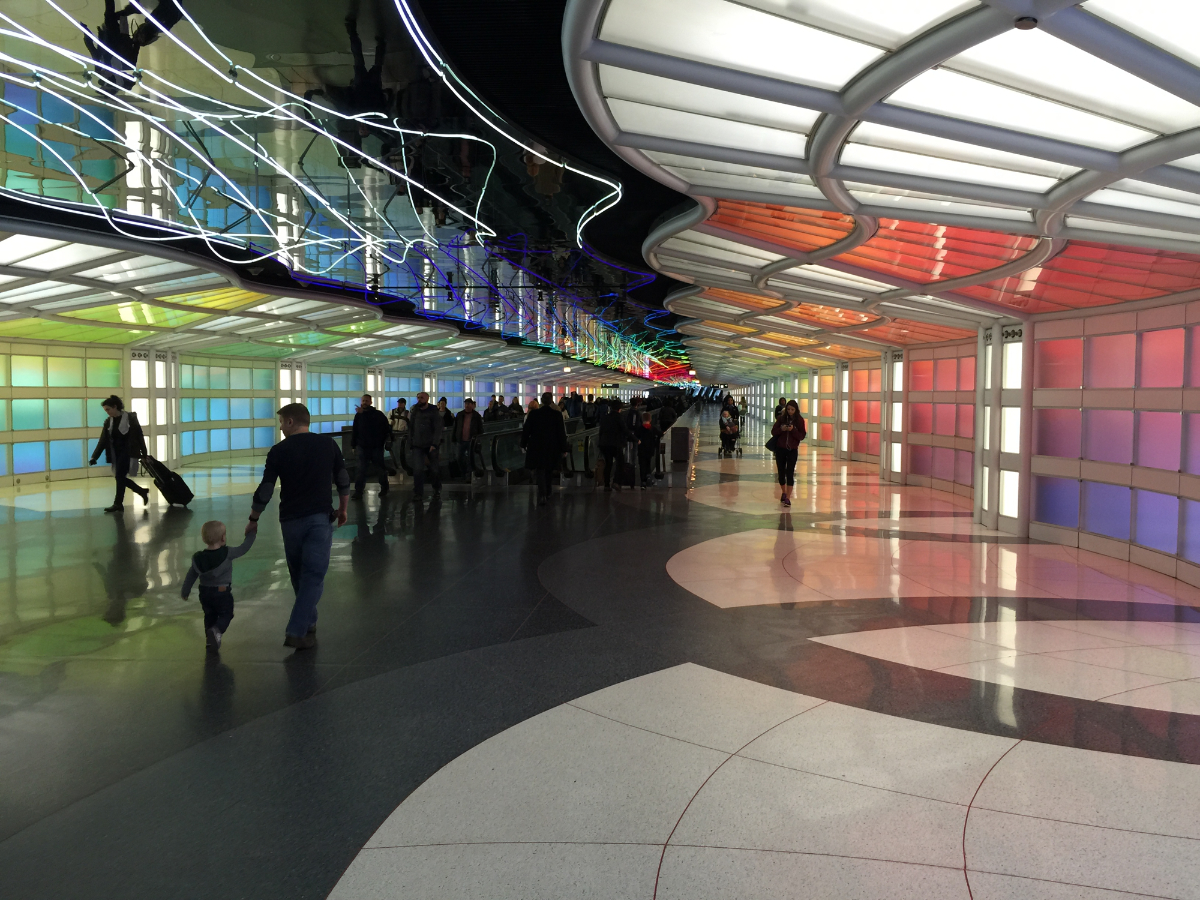

The Zen of Holiday Airline Travel

The Zen of Holiday Airline Travel